- California Assembly OKs highest minimum wage in nation

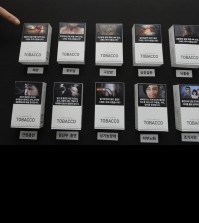

- S. Korea unveils first graphic cigarette warnings

- US joins with South Korea, Japan in bid to deter North Korea

- LPGA golfer Chun In-gee finally back in action

- S. Korea won’t be top seed in final World Cup qualification round

- US men’s soccer misses 2nd straight Olympics

- US back on track in qualifying with 4-0 win over Guatemala

- High-intensity workout injuries spawn cottage industry

- CDC expands range of Zika mosquitoes into parts of Northeast

- Who knew? ‘The Walking Dead’ is helping families connect

Samsung sees tough 2nd half

People stand in front of a Samsung Electronics Co’s showroom in Seoul, South Korea, Thursday, July 31, 2014. Samsung Electronics Co. reported a bigger-than-expected fall in second quarter profit on Thursday and said it was uncertain if earnings from its handset business would improve in the current quarter.(AP Photo/Ahn Young-joon)

By Kim Yoo-chul

Samsung Electronics said Thursday that the second half of the year will be challenging because competition in the heated global handset industry is going to lower device prices.

“It’s unlikely that Samsung will report impressive profits in the third quarter as competition over global market share in handsets intensifies, although Samsung plans to roll out more premium and budget models,” Samsung said in a statement.

“The heated race over price and product specifications will threaten Samsung’s bottom line in profits,” according to the release.

Samsung’s handset division, led by the company’s co-CEO Shin Jong-kyun, reported its second quarter operating profit of 4.42 trillion won, down 30 percent, year-on-year.

Sales fell 20 percent to 28.45 trillion won, Samsung said.

Overall, Samsung’s operating profit was 7.19 trillion won, a decrease from 9.53 trillion won year-on-year. Sales slid 8.9 percent to 52.35 trillion won.

In a conference call to investors and market analysts, Kim Hyun-joon, a senior executive at Samsung’s mobile division, said the world’s biggest smatphone vendor will release a new flagship smartphone with expanded screen size, and another premium handset with changes in surface design.

A big differentiator for Samsung’s devices has been their larger displays, and there are worries Apple’s iPhone 6 will pose a threat.

The Samsung executive said it has already shifted its axis toward budget smartphones as the company has recently started feeling pressure from budget Chinese smartphone makers.

“The rise of budget Chinese smartphone vendors may sap our profit, shortly. However, Samsung will put more resources into lifting the sale of our flagship products,” said Kim.

Samsung shipped 95 million smartphones and 8 million tablets.

For the TV business, the company sees flattened growth for the current quarter.

Samsung sold 12 million flat-screen TVs during the April-June period. But Samsung remains bullish for TVs supporting ultra high-definition (UHD) picture quality.

“The global demand for UHD TVs will rise to 12 million units this year from 1.6 million units last year,” the company said.

Healthy outlook on chips, dividends

Continued tightened supply and healthy demand for chips is expected to benefit Samsung, the world’s biggest memory chip supplier.

“Bit growth for the DRAM industry will remain strong, while the NAND flash market will see a 10 percent level growth in the third quarter,” said Robert Yi, chief of the company’s investor relations team.

Samsung’s logic chip-making division continued bleeding due to a failure to ship more of its processor chips to major clients such as Qualcomm and Apple.

Amid the growing appetite for bendable and curved displays, Samsung said it plans to start the operation of its new line within the first half of 2015.

“Our new A3 line will be tasked to produce flexible OLED panels. The line will be operational from the first half of next year. The capacity volume, however, is subject to calls from our clients and market conditions,” said Lee Chang-hoon, an executive at Samsung Display, a display-making affiliate of Samsung.

Samsung said it will invest 14.4 trillion won on memory chips and 4.9 trillion won on displays. It plans to invest 24 trillion won on facilities throughout this year.

While many analysts are asking top Samsung management to pay more in dividends and to implement shareholder-friendly policies, the Samsung investor relations chief Yi said it’s unlikely that the company will increase dividends to investors in the foreseeable future.

“Samsung Electronics has been maintaining a rather ‘conservative’ strategy in cash management as there are many chances, should we properly respond amid challenging moves in the IT industry. Whether or not to increase dividends isn’t an easy decision. We need some more time,” said Yi.

Samsung plans to invest more cash in next-generation parts such as flexible displays and semiconductors using a very fine 14-nanometer processing technologies.

“We should think more what will be our next growth engines for the next five and 10 years,” said the IR chief Yi.

Investors are calling for Samsung to redistribute its $60 billion cash pile to shareholders.

Samsung’s dividend payout ratio, or how much of its earnings it pays out in dividends, is around 7 percent for the past 12 months, according to Thomson Reuters data, compared with Apple’s 29 percent.