- California Assembly OKs highest minimum wage in nation

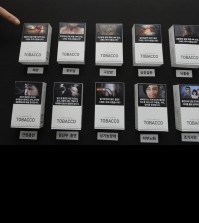

- S. Korea unveils first graphic cigarette warnings

- US joins with South Korea, Japan in bid to deter North Korea

- LPGA golfer Chun In-gee finally back in action

- S. Korea won’t be top seed in final World Cup qualification round

- US men’s soccer misses 2nd straight Olympics

- US back on track in qualifying with 4-0 win over Guatemala

- High-intensity workout injuries spawn cottage industry

- CDC expands range of Zika mosquitoes into parts of Northeast

- Who knew? ‘The Walking Dead’ is helping families connect

China capital flows into S. Korean entertainment agencies

SEOUL (Yonhap) — More Chinese companies are becoming major stakeholders of South Korean entertainment agencies, a trend that could be positive for the expansion of “hallyu,” or the worldwide popularity of Korean culture, but worrisome for its long-term future.

Chinese investors have injected 3 trillion won (US$2.5 billion) over the past five years into South Korean games, movies and entertainment, according to South Korea’s Small and Medium Business Administration.

That is a huge departure from even about a year ago when memoranda of understanding were more common than direct investments.

The Signal Entertainment Group Corp. is the latest case in point. The South Korean agency recently issued 21.45 billion won (US$17.89 million) worth of shares to Spearhead Integrated Marketing Communication Co., according to its regulatory filing. The Chinese marketing company will soon become the largest shareholder of the agency, which manages actresses Kim Hyun-joo and Lee Mi-yeon.

The trend of Chinese firms taking over South Korean ones started much earlier. In 2014, Juna International Ltd., a Chinese entertainment company, took over Chorokbaem Media, which produced South Korean soap opera hits like “The Producers,” “All In” and “Jumong” over the past decades.

Control over Chorokbaem Media shifted to China’s DMG Group, which bought 25.92 percent of the company’s shares, in November 2015.

Meanwhile, Chorokbaem Media bought three other local entertainment firms around the same time, putting all three of them under DMG’s control.

FNC Entertainment, which manages CNBLUE and AOA, also issued millions of dollars worth of new shares to Suning Universal Media Co. last year.

Even earlier this month, the Yedang Company signed a memorandum of understanding with Banana Project, owned by the son of Chinese business magnate Wang Jialin, to launch a joint venture managing young artists.

These examples demonstrate just how lucrative South Korean entertainment is considered to be in the world’s most populous country.

On one hand, the influx of Chinese capital is welcome for cash-strapped agencies and those trying to enter the Chinese market.

Without the help of Chinese investors, it would be difficult for South Korean agencies to make a splash in the world’s most populous country, said Kim Gwang-soo, head of the agency that manages T-ARA.

“Joining hands with companies in China allows us to find our niche more easily,” he said. “Just like many South Korean artists debuted in Japan with the help of local talent agencies, T-ARA is doing the same in China.”

But some analysts warn that the Chinese management of South Korean content could jeopardize “hallyu” by exposing the expertise that South Korean agencies have worked decades to accumulate.

“Chinese capital is a boon to K-pop’s expansion in the short term,” an official at the overseas marketing department of a South Korean music label said, asking not to be named. “In the long run, though, it would give Chinese investors the authority to do whatever they want with Korean content.”

Park Sang-ju, head of the Corea Drama Production Association, said agencies financed by Chinese capital shouldn’t have to sacrifice their South Korean identity.

“People have been worried that South Korean resources would be used towards making Chinese soap operas,” he said. “In reality, though, that hasn’t been the case. I think it’s a matter of how the money is used.”

South Korean agencies should use the capital to experiment with different ideas they haven’t been able to in the past due to financial constraints, Park said.

“If used well, it could be an opportunity to transcend the limits of the South Korean market,” he said.