- California Assembly OKs highest minimum wage in nation

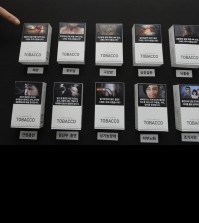

- S. Korea unveils first graphic cigarette warnings

- US joins with South Korea, Japan in bid to deter North Korea

- LPGA golfer Chun In-gee finally back in action

- S. Korea won’t be top seed in final World Cup qualification round

- US men’s soccer misses 2nd straight Olympics

- US back on track in qualifying with 4-0 win over Guatemala

- High-intensity workout injuries spawn cottage industry

- CDC expands range of Zika mosquitoes into parts of Northeast

- Who knew? ‘The Walking Dead’ is helping families connect

Banking stocks lead the way as US stocks rebound

NEW YORK (AP) — U.S. stocks are inching higher Tuesday after sharp sell-offs last week. Strong results from investment bank Morgan Stanley are boosting financial stocks, but energy and mining stocks continue to slump.

KEEPING SCORE: The Dow Jones industrial average rose 44 points, or 0.3 percent, to 16,031 as of 1:25 p.m. Eastern. The Standard & Poor’s 500 index added three points, or 0.2 percent, to 1,883. The Nasdaq composite index lost three points to 4,485.

The gains were small but spread out. Financial stocks, utilities and telecommunications companies all rose. Consumer goods maker Procter & Gamble gained $1.35, or 1.8 percent, to $76.33 and Mondelez added $1.02, or 2.5 percent, to $41.34.

ENERGY: Benchmark U.S. crude fell 60 cents, or 2 percent, to $28.82 a barrel in New York. Brent crude, a benchmark for international oils, rose 62 cents, or 2.2 percent, to $29.17 a barrel in London.

Energy and mining stocks continued to fall on concerns about reduced worldwide demand. Chesapeake Energy lost 36 cents, or 10.1 percent, to $3.20. The price of gold declined, and Newmont Mining lost $1.24, or 7 percent, to $16.46.

TOUGH YEAR: Stocks fell sharply on Friday, and the first two weeks of this year were the worst start to a year in the history of the Dow and the S&P 500. Both indices have fallen about 8 percent so far in 2016 on concerns about the Chinese economy, which is the second-largest in the world and an important contributor to global growth.

TIFFANY TUMBLES: Jewelry retailer Tiffany fell after it said sales dropped in the fourth quarter. The company also forecast minimal growth in 2016. The stock lost $2.18, or 3.2 percent, to $65.47.

EARNINGS: Delta Air Lines reported a bigger fourth-quarter profit because of falling fuel prices. Delta expects fuel to be even less expensive in the first quarter. Its shares rose $1.51, or 3.4 percent, to $46.01. Health insurer UnitedHealth Group posted stronger-than-expected results in the fourth quarter. Its stock rose $3.06, or 2.8 percent, to $112.33.

Netflix, which was the biggest gainer on the S&P 500 in 2015, rose $4.67, or 4.5 percent, to $108.81 as it prepared to report its fourth-quarter results after the market closes.

IPOS A NO-GO: So far not a single U.S. company has gone public this year, according to Kathy Smith of Renaissance Capital, a manager of IPO-focused exchange-traded funds. That should change this week, as Elevate Capital, which offers credit and related services to people with below-average credit, is expected to start trading Friday. But Smith said only two companies will go public this month. There were also just two IPOs in December, the fewest in any month since October 2011.

“The IPO market is pretty close to being closed,” Smith said.

Companies are reluctant to go public when the market is weak, and the companies that did go public last year weren’t rewarded for it: Smith says the companies that completed their IPOs in 2015 are down an average of 17 percent from their offering prices.

OVERSEAS: European and Asian stocks rallied after China’s quarterly economic growth met expectations. That calmed investors who thought conditions might get worse. Still, the Chinese government reported that annual growth hit a 25-year low in 2015.

France’s CAC 40 rose 2 percent and Germany’s DAX added 1.5 percent. Britain’s FTSE 100 gained 1.7 percent. China’s Shanghai Composite surged 3.2 percent and Hong Kong’s Hang Seng gained 2.1 percent. Japan’s Nikkei 225 inched up 0.5 percent.

CURRENCIES: The U.S. dollar inched up to 117.51 yen from 117.50 yen on Monday. The euro rose to $1.0927 from $1.0885. The yield on the 10-year Treasury note, which has slumped this year, held steady at 2.04 percent.