- California Assembly OKs highest minimum wage in nation

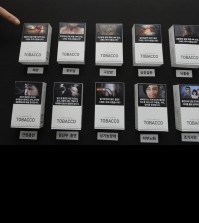

- S. Korea unveils first graphic cigarette warnings

- US joins with South Korea, Japan in bid to deter North Korea

- LPGA golfer Chun In-gee finally back in action

- S. Korea won’t be top seed in final World Cup qualification round

- US men’s soccer misses 2nd straight Olympics

- US back on track in qualifying with 4-0 win over Guatemala

- High-intensity workout injuries spawn cottage industry

- CDC expands range of Zika mosquitoes into parts of Northeast

- Who knew? ‘The Walking Dead’ is helping families connect

Bold predictions for Apple: Truth or Hype?

Apple CEO Tim Cook introduces the new iPhone 6 and iPhone 6 Plus on Tuesday, Sept. 9, 2014, in Cupertino, Calif. (AP Photo/Marcio Jose Sanchez)

By The Korea Times Los Angeles staff

Billionaire investor Carl Icahn publicly released a letter he wrote to Apple CEO Tim Cook on Oct. 9 stating “the market misunderstands and dramatically undervalues” the company’s stocks.

In this roughly 4,000 word letter, Icahn throws out the projected figure of $203 per share when the stock was listed at $100.80 when the markets closed on Wednesday.

The conversation was sparked by Apple’s most recent success with its iPhone 6 line in which 10 million units were sold within the first weekend.

Apple’s move into the “phablet” market isn’t necessarily a revolutionary move by any means because Samsung pioneered the entire mobile device industry into that territory.

Instead Apple should be lauded more for its timing in regards to the iPhone 6 line’s release.

With arguably the most zealous customer base in the tech industry, Apple, along with Chinese manufacturers of cheaper large screen phones, is bringing Samsung to its knees.

Within the past week, Samsung has already warned shareholders to expect a significant decrease in profits going into the fourth fiscal quarter.

Icahn went on to outline why the potential value of Apple goes beyond this latest product release.

In his letter, he mentions the October 2014 launch of Apple Pay, a yet-to-be released app that allows users to aggregate their debit and credit cards into one simple solution as well as an UltraHD Apple TV set, which the public might expect in 2016.

Again, neither of these ideas are revolutionary or innovative at their core.

First off, after the iCloud scandal in which compromising photos of many celebrities were stolen and released to the public, it wouldn’t be far-fetched to assume potential users are skeptical about handing over their credit card information to the tech giant.

Secondly, 2016 is pretty far off in the tech world both fiscally and in terms of technological advancement. A lot can happen between now and then including an unforeseen evolution in viewership preferences and behavior. Maybe they can just wait and see how the Samsung curved television does and take over that market when it seems convenient.

Lastly, Apple is already delaying production on its latest larger-screen iPad just a few months before its proposed release date due to factory and labor limitations, so when it says 2016, it’s more like “2016?”

Icahn’s bottom line was that because he believes so deeply in the company’s immediate future, Apple should expedite its buyback program, which is already authorized to spend $90 billion in reacquiring its own shares.

Despite the excitement surrounding the letter, the fact that it was so publicly released gives the whole situation an air of hype to excite Apple stock prices and to strengthen the faith of its shareholders. Regardless, Icahn makes some valid arguments in the letter so only time will tell how this situation plays out.