- California Assembly OKs highest minimum wage in nation

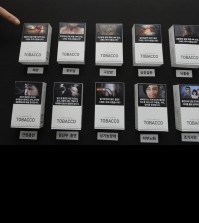

- S. Korea unveils first graphic cigarette warnings

- US joins with South Korea, Japan in bid to deter North Korea

- LPGA golfer Chun In-gee finally back in action

- S. Korea won’t be top seed in final World Cup qualification round

- US men’s soccer misses 2nd straight Olympics

- US back on track in qualifying with 4-0 win over Guatemala

- High-intensity workout injuries spawn cottage industry

- CDC expands range of Zika mosquitoes into parts of Northeast

- Who knew? ‘The Walking Dead’ is helping families connect

China’s growing trade power hurting S. Korean exports

SEJONG, May 5 (Yonhap) – China’s growing competitiveness in international trade is causing South Korean exports to lose market share, which can spell trouble for Asia’s fourth-largest economy, a report said Tuesday.

Chinese products with good export potential are forcing South Korean goods to surrender market share, the Korea Development Institute (KDI) said in the report based on the assessment of how a country’s emergence on the global trade arena affects others among South Korea, Japan and China.

Such developments are reminiscent of what occurred in the 1990s when growth of South Korean goods adversely affected Japanese exports, it said.

“From the third to the fourth quarters of last year, there was a steady rise in global trade volume, yet South Korean exports continued to backtrack, which raised alarm bells,” it said.

While in the mid 1990s when South Korea and China both took market share from Japanese goods, more recent data showed locally made goods starting to fall behind.

In 2013, South Korea enjoyed global competitiveness in such areas as machinery, transportation equipment, industrial chemicals and certain manufactured goods, the report said.

Japan too was strong in these fields just before it started to lose market presence amid more South Korean and Chinese goods in the 1990s.

“South Korea’s comparative advantage in goods like machinery and information processing equipment has fallen some 70 percent in the last decade. Even in the realm of telecommunication and audio recording areas, where local companies still enjoy competitiveness, the advantage has been slashed by 50 percent vis-a-vis Chinese goods,” the KDI said.

South Korea’s global market share in some goods where China is strong dropped around 20 percent by 2011 compared to a decade earlier.

Jung Kyu-chul, an associate fellow for the institute, said that while South Korean companies clearly hold an edge in high-end television and telecommunication-related parts, China’s export potential in these same areas has been rated as being very high.

“This can translate into a 30 percent dip in market share by 2017,” the researcher warned.

He said that despite South Korea making headway against Japan, the latter has maintained its lead in specialized industrial equipment, high-tech machine tools, vehicles, picture-taking products, optics and time pieces.

Jung said that South Korea must now move away from just following the technological lead of others and begin to develop more original products that cannot be copied easily by developing countries if it wants to stay ahead and protect it overseas market presence.