- California Assembly OKs highest minimum wage in nation

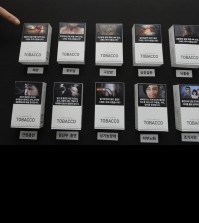

- S. Korea unveils first graphic cigarette warnings

- US joins with South Korea, Japan in bid to deter North Korea

- LPGA golfer Chun In-gee finally back in action

- S. Korea won’t be top seed in final World Cup qualification round

- US men’s soccer misses 2nd straight Olympics

- US back on track in qualifying with 4-0 win over Guatemala

- High-intensity workout injuries spawn cottage industry

- CDC expands range of Zika mosquitoes into parts of Northeast

- Who knew? ‘The Walking Dead’ is helping families connect

Fed keeps US interest rates low amid weak global economy

WASHINGTON (AP) — The Federal Reserve is keeping U.S. interest rates at record lows in the face of threats from a weak global economy, persistently low inflation and unstable financial markets.

Ending a highly anticipated meeting, Fed officials said Thursday that while the U.S. job market is solid, global pressures may “restrain economic activity” and further drag down already low inflation.

Signs of a sharp slowdown in China have intensified fear among investors about the U.S. and global economy. And low oil prices and a high-priced dollar have kept inflation undesirably low.

Before year’s end, many analysts still expect the Fed to raise its key short-term rate, which it’s kept near zero since 2008. A higher Fed rate would eventually send rates up on many consumer and business loans.

“All this really does is punt,” said Scott Clemons, chief investment strategist for Brown Brothers Harriman’s private banking business.

Clemons said he expects the Fed to raise rates before the end of the year, especially if concern in the financial markets about China’s economic prospects eases.

“The Fed is paying attention to what is going on abroad,” he said. “That’s all code for China.”

Wall Street’s early reaction to the Fed’s decision, which investors had widely expected, was muted. U.S. stock indexes were up slightly and roughly where they were before the Fed released its policy statement at 2 p.m. Eastern time.

Bond investors seemed cheered by the Fed’s decision to keep rates ultra-low. The yield on the 10-year Treasury note fell to 2.23 percent from 2.30 percent late Wednesday. Bond prices tend to rise and yields tend to fall when investors expect subdued inflation, low rates and modest economic growth.

Financial markets had been zigzagging with anxiety as investors tried to divine whether the Fed would start phasing out the period of extraordinarily low borrowing rates it launched at a time of crisis.

The Fed’s action Thursday was approved on a 9-1 vote, with Jeffrey Lacker casting the first dissenting vote this year. Lacker, president of the Fed’s Atlanta regional bank, had pushed for the Fed to begin raising rates by moving the federal funds rate up by a quarter-point.

Instead, the Fed retained language it has been using that it will be appropriate to raise interest rates when it sees “some further improvement in the labor market” and is “reasonably confident” that inflation will move back to the Fed’s optimal inflation target of 2 percent.

The Fed’s preferred measure of inflation was up just 1.2 percent in the latest reading and has been below 2 percent for more than three years.

In an updated economic forecast, 13 of the 17 Fed policymakers said they see the first rate hike occurring this year. In June, 15 Fed officials had predicted that the first rate hike would occur this year.

The forecast also reduced the number of rate hikes this year to show an expectation of just one quarter-point increase, rather than the two that had been the expectation at the June meeting.

The new forecast significantly lowered the expectation for inflation this year to show the Fed’s preferred inflation gauge rising just 0.4 percent, down from a 0.7 percent forecast in June. The change takes into account the further rise in the value of the dollar, which makes imports cheaper, and a recent drop in oil prices. The Fed’s forecast still foresees inflation accelerating to a 1.7 percent increase next year, still below its 2 percent target.

The new forecast has unemployment dropping to 5 percent by the end of this year, down from 5.3 percent in June. The unemployment rate in August dropped to a seven-year low of 5.1 percent.

Before Thursday’s decision, some economists argued that many factors – from a sharply slowing China to the tumult in markets to persistently less-than-optimal inflation – raised concerns about a rate hike. Others contended that with the U.S. job market considered essentially recovered from the Great Recession, it was time to start edging toward normal rates.

The anxiety that gripped investors stemmed in part from concern that once the Fed starts raising its key rate, other rates – for mortgages, car loans, business borrowing – will eventually rise. Some fear the economy might suffer.

Yet the Fed’s influence on many consumer and business rates is only indirect. In the short run at least, those rates could continue to stay low, held down by low inflation globally and by a flow of money into U.S Treasurys.

Fed officials have stressed that once the central bank starts raising rates, the process will be extremely gradual. The Fed might pause for months after its first hike and assess the consequences before proceeding further. Still, economists generally say the effects of a series of small rate hikes will be negligible.

Until turmoil struck markets this summer, a September rate hike seemed a lock. Then, China’s surprise decision to devalue its currency ignited fears that the world’s second-largest economy was weakening faster than assumed. Stocks tumbled.

At an economic conference last month in Jackson Hole, Wyoming, Fed officials sent mixed signals about this week’s meeting. Some indicated they were ready to raise rates if markets had settled and if the economy kept improving.

In July, when Yellen delivered an economic report to Congress, she reiterated that the Fed would likely raise rates before year’s end. But she wasn’t specific.