- California Assembly OKs highest minimum wage in nation

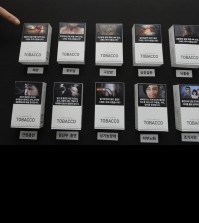

- S. Korea unveils first graphic cigarette warnings

- US joins with South Korea, Japan in bid to deter North Korea

- LPGA golfer Chun In-gee finally back in action

- S. Korea won’t be top seed in final World Cup qualification round

- US men’s soccer misses 2nd straight Olympics

- US back on track in qualifying with 4-0 win over Guatemala

- High-intensity workout injuries spawn cottage industry

- CDC expands range of Zika mosquitoes into parts of Northeast

- Who knew? ‘The Walking Dead’ is helping families connect

IMF urges S. Korea to act against downside risks

International Monetary Fund Mission Chief to Korea Brian Aitken speaks at a press conference in Seoul on Feb. 13, 2015, wrapping up the mission’s 11-day visit to the country. (Yonhap)

By Lee Minji and Kim You Jin

SEOUL (Yonhap) — The International Monetary Fund (IMF) has urged South Korea to act against what it describes as a “self-reinforcing downside dynamic,” since Asia’s fourth-largest economy has room for additional monetary and fiscal measures to reduce downside risks.

“There is the risk that a self-reinforcing downside dynamic could take hold … The likelihood of this scenario may not be high, but the costs could be significant. The authorities have monetary and fiscal policy space to take action if clear signs of a recovery do not emerge soon,” Brian Aitken, who spearheaded the international agency’s annual consultations with South Korea, said in a news conference on Friday.

The IMF’s seven-member team visited the country from Feb. 2-13 to hold meetings with officials from the finance ministry and the Bank of Korea to discuss Asia’s fourth-largest economy.

The Washington D.C.-based organization cut its growth forecast for the country to 3.7 percent from 4 percent last week, without providing details.

“We urge them to use that policy space if needed to avoid the sort of scenario we described, of self-reinforcing low inflation, low growth environment, which we’ve known from past experience is a very difficult dynamic to break out of once you get into it.”

The visiting IMF official, however, stressed that such a scenario does not always translate into deflation.

“We’re not necessarily talking about outright deflation. A downside scenario could be a prolonged period of low inflation as well.”

The recommendation comes as South Korea finds itself squeezed between the U.S. Federal Reserve’s rate normalization trend and a global wave of monetary easing, while juggling economic woes, both structural and cyclical, such as rapid aging and slowing exports.

Aitken said that the 3.7 percent forecast is “still feasible,” but hinted at chances of a revision by noting the outlook was made before the country’s downbeat fourth-quarter growth data was released.

South Korea grew 0.4 percent in the October-December period, sharply decelerating from 0.9 percent growth three months earlier and posting the slowest growth in over two years, according to central bank data released late last month.

He also stressed uncertainties in the growth forecast, saying it is premature to assess the impact of Seoul’s recent fiscal and monetary moves, such as the two rounds of rate cuts aimed at spurring growth.

“It’s too early to gauge their full impact on the economy, and then you add to that the uncertain elements of the global economy. It is very difficult to know at this point what the headline 2015 number will be.”

South Korea’s central bank cut its base rate by two times last year to a record low of 2 percent in October, in order to support the government’s stimulus efforts.