- California Assembly OKs highest minimum wage in nation

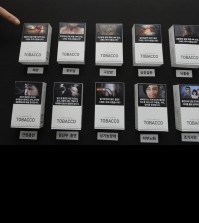

- S. Korea unveils first graphic cigarette warnings

- US joins with South Korea, Japan in bid to deter North Korea

- LPGA golfer Chun In-gee finally back in action

- S. Korea won’t be top seed in final World Cup qualification round

- US men’s soccer misses 2nd straight Olympics

- US back on track in qualifying with 4-0 win over Guatemala

- High-intensity workout injuries spawn cottage industry

- CDC expands range of Zika mosquitoes into parts of Northeast

- Who knew? ‘The Walking Dead’ is helping families connect

S. Korean economy recovering at slower pace than other major countries

SEOUL (Yonhap) — South Korea’s macroeconomic conditions have been recovering at a slower pace than other major countries since the global financial crisis in the late 2000s, a think tank said Tuesday.

According to a report by the Korea Economic Research Institute, growth rates for seven out of eight key macroeconomic indicators for South Korea have slowed compared with the years before the financial crisis in 2009.

The think tank analyzed such indicators related to gross domestic product, private spending, unemployment, investment, trade and stock and housing markets. It compared the figures to those of seven other major economies including the U.S., Japan and Germany.

The report showed that South Korea posted a marked decline in growth rates for private spending, imports, exports, stock and housing markets. Unemployment remained almost unchanged, but investment slowed slightly.

The U.S., meanwhile, improved in many areas, apparently driven by the government-led quantitative easing aimed at injecting massive amounts of money into the market to keep interest rates low, the report showed.

Its indicators related to economic growth, unemployment and stock and private consumption turned around for the better.

Japan also posted improvements in three areas — unemployment, investment and stock market conditions, according to the report.

The think tank said that South Korea’s heavy dependence on external markets might be the reason for its relatively poor economic performance over the past years, which could offset the effect of its own expansionary monetary policies.

“Our country has also enforced expansionary monetary policies such as rate cuts, but they haven’t been able to boost stock and housing markets,” the think tank said.

“Due in part to our economic structure that depends much on external markets, such outside uncertainties as a slowdown in China’s economic growth could have served as a drag on private-sector consumption,” it added.