- California Assembly OKs highest minimum wage in nation

- S. Korea unveils first graphic cigarette warnings

- US joins with South Korea, Japan in bid to deter North Korea

- LPGA golfer Chun In-gee finally back in action

- S. Korea won’t be top seed in final World Cup qualification round

- US men’s soccer misses 2nd straight Olympics

- US back on track in qualifying with 4-0 win over Guatemala

- High-intensity workout injuries spawn cottage industry

- CDC expands range of Zika mosquitoes into parts of Northeast

- Who knew? ‘The Walking Dead’ is helping families connect

Samsung Electronics likely to post record Q4 sales on upbeat chip biz

Samsung Electronics Co. said Friday it is likely to post record quarterly sales in the fourth quarter of last year, boosted by its solid semiconductor business.

The company expected the sales to hit 76 trillion won (US$63.1 billion) in the September-December period, up 23.5 percent from a year earlier, it said in the earnings preview.

Operating profit likely reached 13.8 trillion won in the fourth quarter, up 52.5 percent from the previous year.

If the tentative figures stand, the sales would mark the largest ever for the world’s biggest memory chip and smartphone maker, following the previous record quarterly high of 73.9 trillion won three months ago.

For all of 2021, the tech giant is expected to have registered record annual sales of 279 trillion won, up 17.8 percent from the previous year’s 236.8 trillion won. The cumulative operating profit for the year is likely to stand at 51.6 trillion won, up 43.3 percent from 2020 and the third-largest ever.

The fourth-quarter operating income estimate, however, missed the market consensus of 15.2 trillion won compiled by Yonhap Infomax, the financial data arm of Yonhap News Agency.

Compared with the third quarter, the operating profit shrank 12.8 percent, while the sales rose 2.7 percent, according to the estimates.

Friday’s guidance did not include breakdown figures for its respective business divisions. Samsung will release the full earnings result later this month.

Analysts said strong demand for server memory chips and a less-than-expected fall in DRAM and NAND flash average selling prices likely helped buoy the overall performance.

“The foundry is also expected to have improved profitability compared with the previous quarter due to more supplies and higher prices,” Park Seong-soon, an analyst at Cape Investment & Securities Co., said.

The component shortages appear to have also eased in the third quarter compared with the previous three months, which likely also contributed to a sales boost in the mobile sector, analysts said.

Its display panel business is expected to have fared well given the fourth-quarter peak season, but the increased costs from the new QD-display production likely weighed on the performance.

Analysts predicted an operating income of between 9.6-9.8 trillion won for the semiconductor business, about 1.5 trillion won for the display division, about 2.9-3.1 trillion won for the mobile business and around 850 billion won for consumer electronics.

Shares in Samsung Electronics rose 1.82 percent to 78,300 won Friday, outperforming the broader KOSPI’s 1.18 percent gain.

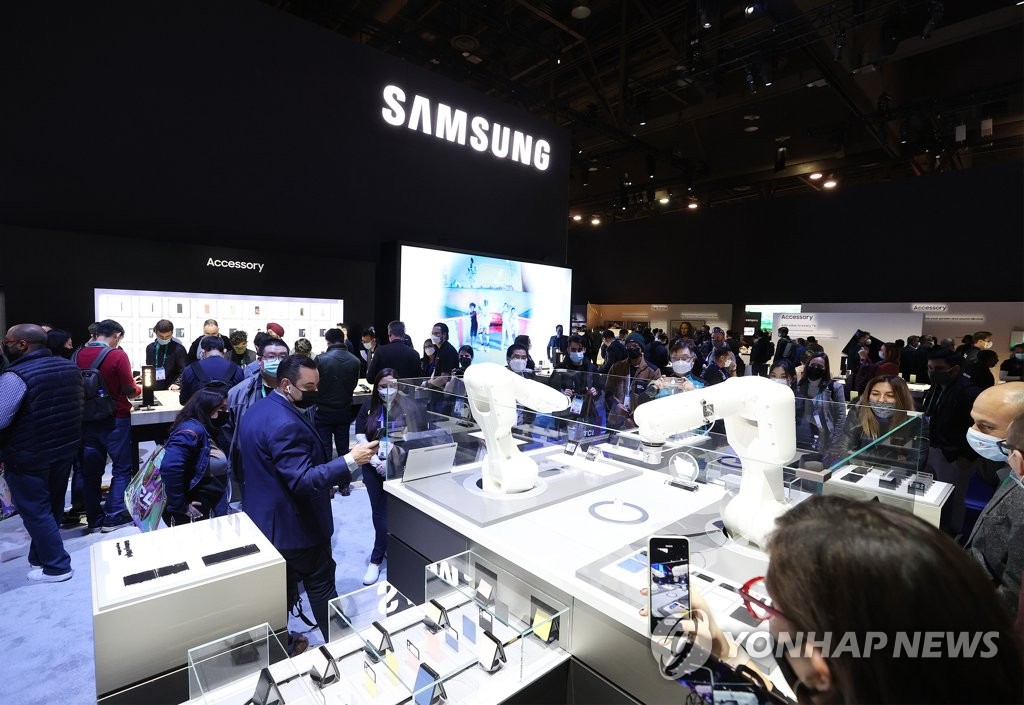

The Samsung Electronics booth bustles with visitors at the Consumer Electronics Show in Las Vegas on Jan. 5, 2022, in this photo provided by SK. (PHOTO NOT FOR SALE) (Yonhap)