- California Assembly OKs highest minimum wage in nation

- S. Korea unveils first graphic cigarette warnings

- US joins with South Korea, Japan in bid to deter North Korea

- LPGA golfer Chun In-gee finally back in action

- S. Korea won’t be top seed in final World Cup qualification round

- US men’s soccer misses 2nd straight Olympics

- US back on track in qualifying with 4-0 win over Guatemala

- High-intensity workout injuries spawn cottage industry

- CDC expands range of Zika mosquitoes into parts of Northeast

- Who knew? ‘The Walking Dead’ is helping families connect

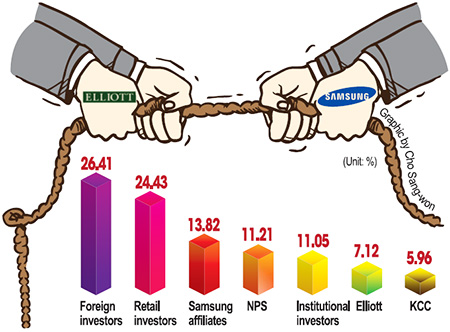

Samsung seeks to win big against Elliott

Samsung C&T co-CEO Kim Shin answers questions from reporters about the latest updates in the firm’s ongoing feud with Elliott Associates after he participated in Wednesday’s regular weekly meeting with presidents of key Samsung affiliates at the Seocho Samsung Tower, southern Seoul, Wednesday. / Yonhap

Individual investors hold key in vote

By Kim Yoo-chul

Samsung C&T seeks to win big in a battle against Elliott Associates over its proposed merger with Cheil Industries at its shareholders’ meeting, Friday.

“We should score a victory by a big margin in the first battle in order to take the upper hand in a looming war against Elliott and keep other speculative hedge funds from taking short-term gains in the domestic market,” Samsung Securities CEO Yoon Yong-am told reporters, Wednesday.”

Yoon said Samsung needs stronger support from retail investors who hold a combined 24 percent stake in the construction unit of the Samsung Group.

Samsung C&T co-CEO Kim Shin also asked retail investors to vote for the merger as it will boost the company’s stock value.

“Samsung C&T needs more support from individual investors. I promise the merged Samsung C&T-Cheil Industries will maximize value for individual shareholders. There’s no doubt about that. Please support us,” Kim said.

The merger needs to get a two-thirds majority. Yoon expected the participation rates for the July 17 meeting to reach 80 percent, meaning Samsung needs some 53 percent of the votes to pass the merger proposal.

Officials say that it has secured some 40 percent through friendly shareholders. The National Pension Service (NPS), the top shareholder in Samsung C&T with 11.21 percent, is expected to vote for the plan.

Elliott Associates, the third-largest shareholder in the construction firm, is said to have secured some 20 percent through shareholders opposing the merger.

Individual investors hold a 24.43 percent stake in Samsung C&T.

Kim was thankful for the increased support from individual shareholders and stressed Samsung feels a “huge responsibility” to respond to their needs.

“As the fight intensifies, Samsung has acknowledged the importance of sincere communication. Another co-CEO Choi Chi-hun was also out of the office seeking more support from individual investors. This battle made Samsung realize we have to respect minority shareholders,” Kim said.

In a statement, Elliott said individual investors should vote against the merger.

“This is your last chance to protect the value of your investment in a business which has a long and successful history of producing value for its stakeholders, so we urge all Samsung C&T shareholders to vote ‘No’ to the wholly unfair merger at the shareholders’ meeting,” it said.

The all-stock swap ratio between Cheil Industries and Samsung C&T was set at 1:0.35, which Elliott and some foreign investors believe is unfair given the gap in net asset value between Samsung C&T and Cheil.

Samsung said it will not raise the ratio as it was set in correspondence with Korea’s Capital Law.

Elliott claims that the ratio should be revised to 1:0.95. The two companies are currently involved in a local court after Samsung sued Elliott for the fund’s alleged involvement in fabricating documents.

Yoon said Elliott Associates will lower its position in Samsung C&T to two percent if the merger is approved.

“Samsung really wants to send a message that vulture funds won’t be welcome in Korea by closing the deal with more support from individual investors,” he added.