- California Assembly OKs highest minimum wage in nation

- S. Korea unveils first graphic cigarette warnings

- US joins with South Korea, Japan in bid to deter North Korea

- LPGA golfer Chun In-gee finally back in action

- S. Korea won’t be top seed in final World Cup qualification round

- US men’s soccer misses 2nd straight Olympics

- US back on track in qualifying with 4-0 win over Guatemala

- High-intensity workout injuries spawn cottage industry

- CDC expands range of Zika mosquitoes into parts of Northeast

- Who knew? ‘The Walking Dead’ is helping families connect

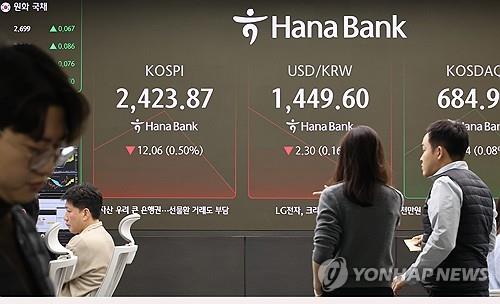

Seoul eases regulation to boost foreign currency inflow amid weak Korean won

Financial authorities announced new policy measures to ease regulations governing the inflow of foreign currency Friday, one day after the South Korean won fell to its weakest level in more than 15 years.

The local currency had long been under mounting pressure stemming from domestic political turmoil. It dropped sharply against the U.S. dollar Thursday to reach the 1,450 won level, the lowest since March 2009, after the U.S. Fed hinted at two rate cuts next year instead of the initial four.

“Considering changes in the international financial and foreign exchange (FX) market environment, we have decided to reassess our policy framework,” a finance ministry official said, adding that restrictions on FX inflows would be eased within limits that ensure external stability.

First, the cap on FX forward positions for local lenders will be raised from the current 50 percent to 75 percent, according to the ministry. For foreign bank branches operating in the country, the limit will be increased from 250 percent to 375 percent.

Easing the limits is expected to help the lenders secure foreign currency liquidity more efficiently, the ministry said. The policy was initially introduced in 2010 to curb excessive foreign borrowing.

The authorities also said they plan to relax restrictions on foreign currency loans provided by domestic banks to residents who use the funds for non-Korean won purposes.

The changes will allow companies, regardless of their size, to access foreign currency loans for facility investment, the authorities said.

Previously, such loans were mostly prohibited, except for limited cases involving facility funding for small and medium enterprises.

“Increased FX loans are expected to enhance FX liquidity in the market, potentially lowering the Korean won-U.S. dollar exchange rate,” the official said.