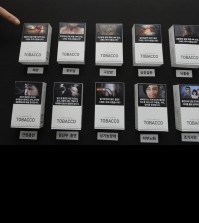

- S. Korea unveils first graphic cigarette warnings

- US joins with South Korea, Japan in bid to deter North Korea

- LPGA golfer Chun In-gee finally back in action

- S. Korea won’t be top seed in final World Cup qualification round

- US men’s soccer misses 2nd straight Olympics

- US back on track in qualifying with 4-0 win over Guatemala

- High-intensity workout injuries spawn cottage industry

- CDC expands range of Zika mosquitoes into parts of Northeast

- Who knew? ‘The Walking Dead’ is helping families connect

- California Assembly OKs highest minimum wage in nation

US stocks head for a 4th straight gain; energy, metals surge

NEW YORK (AP) — Stocks are rising Friday for a fourth day straight after the U.S. government said employers added more jobs than expected in February. Energy and metals prices are gaining ground on the latest sign of strength for the economy, and energy and mining stocks are jumping.

KEEPING SCORE: The Dow Jones industrial average picked up 106 points, or 0.6 percent, to 17,050 as of 2:05 p.m. Eastern time. The Standard & Poor’s 500 index added 14 points, or 0.7 percent, to 2,007. The Nasdaq composite rose 35 points, or 0.7 percent, to 4,742.

The S&P 500 last traded over 2,000 on Jan. 6, the third trading day of the year. The last four-day winning streak for stocks came in early October.

JOBS REPORT: The Labor Department said employers added 242,000 jobs in February as construction, retail and health care companies kept hiring more workers. Consumer demand was solid, and the government also said employers hired more people in December and January than it had previously estimated. More people also looked for work.

THE BIG PICTURE: This week stocks have risen following reports that show the U.S. economy is doing fairly well, including data on construction spending and manufacturing.

Kate Warne, investment strategist for Edward Jones, said she expects continued job and economic growth for the U.S.

“The worries that we’ve been hearing recently about the economy sliding into recession aren’t warranted,” she said. Combined with low inflation rates, she said that’s good news for investors.

METALS: Metals prices kept climbing. Gold, which is trading at its highest price in a year, rose $12.50, or 1 percent, to $1,270.70 an ounce. Silver jumped 55 cents, or 3.6 percent, to $15.69 an ounce and copper rose 7 cents, or 3 percent, to $2.27 a pound.

Copper mining company Freeport-McMoRan gained 80 cents, or 8.7 percent, to $9.90 and aluminum producer Alcoa rose 20 cents, or 2.1 percent, to $9.67.

Companies that make mining equipment and other machinery also traded higher on the prospect that higher metals prices will encourage companies to spend more money on their products. Caterpillar rose $2.09, or 2.9 percent, to $73.84.

OIL: The price of U.S. crude oil rose $1.31, or 3.8 percent, to $35.88 a barrel in New York. Brent crude, the benchmark for international oils, added $1.62, or 4.4 percent, to $38.69 a barrel in London. While U.S. oil is still down significantly this year, Brent, the international standard, is now higher than it was at the beginning of the year.

U.S. oil prices are also on track to rise for the third week in a row, which hasn’t happened since May.

Energy stocks climbed for the fourth day in a row. Southwestern Energy rose to 84 cents, or 11.4 percent, to $8.18 and drilling rig operator Transocean gained $2.43, or 22.4 percent, to $13.26.

BIG SCREEN GETS BIGGER: AMC Theaters, owned by Wanda Group of China, is buying Carmike Cinemas for $1.1 billion. The deal will create the biggest movie theater chain in the world. Earlier this year, Wanda said it would buy Legendary Entertainment, a studio that co-financed movies including “Jurassic World” and “The Dark Knight.” Carmike climbed $4.14, or 16.5 percent, to $29.26.

BONDS: Bond prices tumbled and the yield on the 10-year Treasury note rose to 1.90 percent from 1.84 percent late Thursday.

HP HIGH POINT: Hewlett Packard Enterprise, an information technology products and service company, reported a stronger profit and greater sales than analysts had expected. Its stock surged $1.93, or 14.2 percent, to $15.53.

TAXED: H&R Block tumbled after its quarterly profit and revenue disappointed investors. The company said people are filing their taxes later and refunds are taking longer to process as efforts to fight tax fraud increase. The stock dropped $5.83, or 17.7 percent, to $27.07.

SMITH & WESSON CLIMBS: The handgun maker’s stock rose $1.77, or 7 percent, to $27.17 after its profit and sales surpassed Wall Street estimates. Smith & Wesson also raised its profit and sales projections for its current fiscal year.

STAPLED: Staples lost 9 cents to $9.79 after the office supply chain’s profit and sales were weaker than expected.

OVERSEAS: Britain’s FTSE 100 gained 1.1 percent and France’s CAC 40 rose 0.9 percent. Germany’s DAX was up 0.7 percent. Japan’s Nikkei 225 index closed 0.3 percent higher and Hong Kong’s Hang Seng added 1.2 percent. South Korea’s Kospi edged 0.1 percent lower.

CURRENCIES: The euro rose to $1.0996 from $1.0959 the day before while the dollar rose to 114.21 yen from 113.57 yen.