- California Assembly OKs highest minimum wage in nation

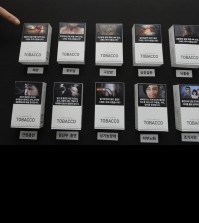

- S. Korea unveils first graphic cigarette warnings

- US joins with South Korea, Japan in bid to deter North Korea

- LPGA golfer Chun In-gee finally back in action

- S. Korea won’t be top seed in final World Cup qualification round

- US men’s soccer misses 2nd straight Olympics

- US back on track in qualifying with 4-0 win over Guatemala

- High-intensity workout injuries spawn cottage industry

- CDC expands range of Zika mosquitoes into parts of Northeast

- Who knew? ‘The Walking Dead’ is helping families connect

Won hits 20-month low vs. dollar

SEOUL, March 16 (Yonhap) — The South Korean won touched a fresh 20-month low against the U.S. dollar Monday on speculation that the U.S Federal Reserve may provide concrete clues on a much-awaited rate hike.

The local currency closed at 1,131.5 per dollar, down 3.0 won from the previous session’s end and the lowest since July 10, 2013 when it ended at 1,135.80 won. The won hit an intra-day low of 1,136.60 won at one point.

The greenback continued its ascent versus its major global counterparts, including the euro and the Japanese yen, as traders bet that the Fed would hint at its rate hike, possibly in the second half of the year, after its two-day policy meeting that starts Tuesday.

Divergence in the global monetary policy has been growing as the Fed is set to raise the borrowing costs while central banks of other major and emerging economies are moving to cut them to ward off deflation and boost sagging economic growth.

Last week, the Bank of Korea (BOK), the country’s central bank, slashed its policy rate by a quarter percentage point to an all-time low of 1.75 percent, expressing concerns that the growth pace in Asia’s fourth-largest economy is slower than what has been expected.

“The won-dollar rate may further rise, but traders’ expectations about the Fed meeting has cashed out to some degree, and we may see increased volatility,” said Jun Seung-ji, an analyst at Samsung Futures Co.

The country’s key stock index, the KOSPI, edged up 1.54 points, or 0.08 percent, to 1,987.33.

The local bond market continued to build up gains as institutional investors swash with ample liquidity snatched up debts following the rate cut.

The yield on benchmark three-year Treasurys stood at a fresh record low of 1.860 percent Monday, down 0.9 basis point, while that on five-year Treasurys fell 2.8 basis points to the lowest level of 1.985 percent.